Why Gold is Still the Smartest Investment for Indian Families | Gold Investment in India

Introduction

Ask any Indian household what their safest bet for wealth is, and you’ll often hear one answer: gold. From weddings to festivals, from small towns to big cities, gold investment in India is not just about money — it’s about trust, culture, and security.

While the younger generation may experiment with stocks, mutual funds, or even cryptocurrency, families still rely on gold when it comes to building a solid financial foundation. And let’s be honest, in India, gold is not just an investment; it’s an emotion.

But why does gold continue to hold such a strong place in our hearts and wallets? Let’s explore.

Families in India buying gold coins on Diwali for prosperity and wealth.

Gold and Indian Culture: A Bond Beyond Wealth

If there’s one metal that represents India’s traditions, it’s gold. Think about weddings — no ceremony is complete without brides adorned in layers of gold jewellery. For parents, buying gold for their children’s marriage is not just tradition; it’s preparation for their future security.

Festivals like Akshaya Tritiya, Diwali, and Dhanteras are marked by long queues outside jewellery stores. The belief is simple: buying gold on these days brings good luck and prosperity.

This cultural connection ensures that even when families invest in modern assets, gold remains a constant in their portfolio. In fact, many households treat gold jewellery as an investment — one that is beautiful to wear and valuable to keep.

Why Gold is a Good Investment for Indian Families

So beyond tradition, why gold is a good investment?

-

Protection from Inflation – When the cost of living rises, gold prices usually rise too. Unlike paper currency, gold doesn’t lose value with inflation.

-

Liquidity and Universal Value – Need cash urgently? Gold can be sold or pledged instantly almost anywhere in the world.

-

Safe Haven During Uncertainty – Stock markets may crash, real estate may slow down, but gold holds steady, making it one of the most trusted safe investment options in India.

This reliability is why families, especially in small towns, continue to save in gold rather than only depending on banks.

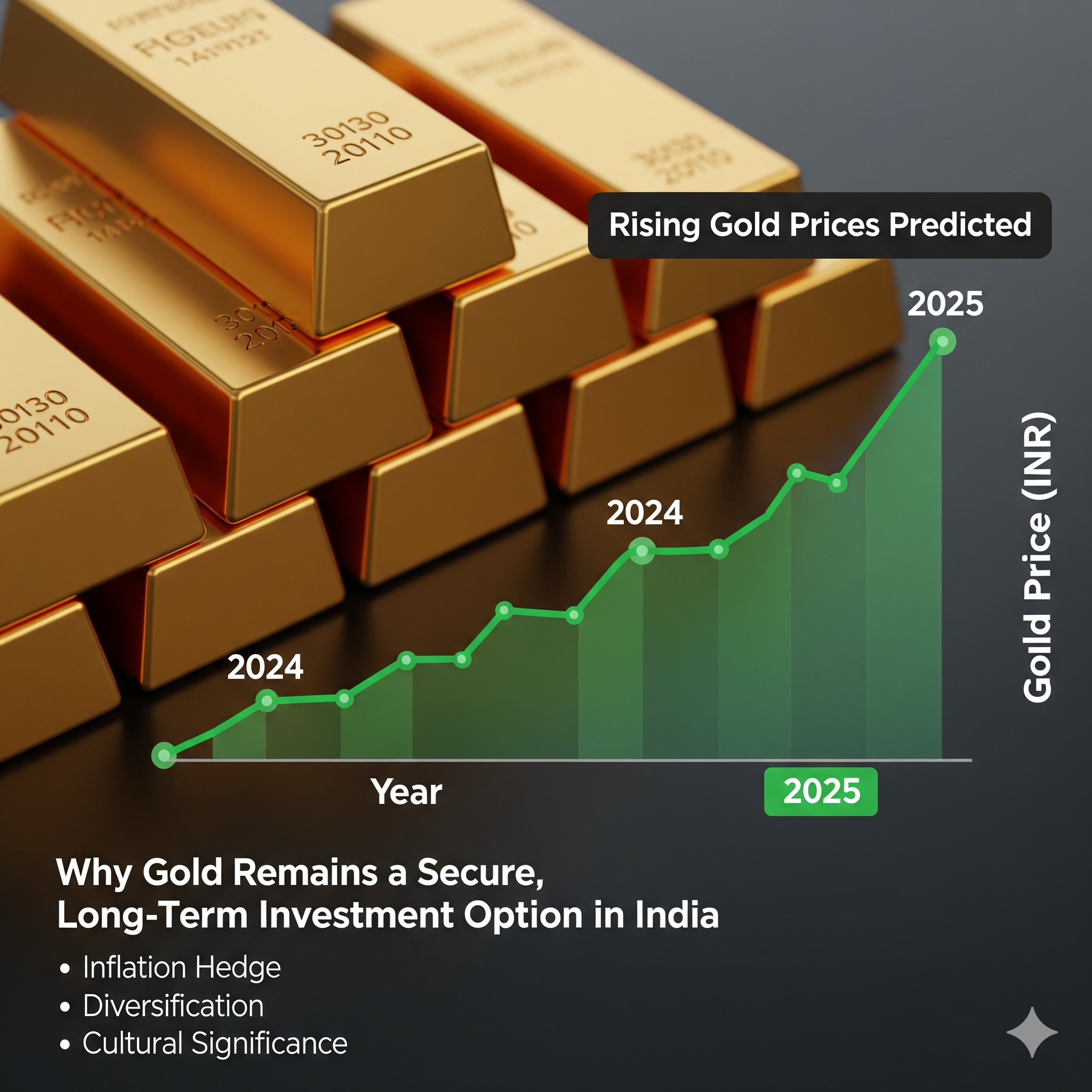

Rising Gold Prices India 2025: What Families Should Know

If you’ve been following the market, you’ll know that gold has been on an upward journey. Analysts predict that rising gold prices in India in 2025 will make gold even more valuable for investors.

The reasons are clear:

-

Inflation is on the rise globally.

-

Geopolitical tensions push investors toward safer assets.

-

Indian demand for gold remains unmatched.

For families, this simply means one thing: investing in gold today could secure bigger returns tomorrow.

Gold bars with a financial growth chart showing increasing prices.

Best Way to Invest in Gold in India

Traditionally, people bought jewellery, coins, and bars. While that’s still popular, the modern Indian investor has more options now.

-

Physical Gold – Still the most common. Jewellery, coins, and bars remain favorite choices. But remember, jewellery comes with making charges.

-

Gold ETFs – Perfect for those who want gold’s benefits without storage hassles. Traded like stocks, they’re easy and safe.

-

Sovereign Gold Bonds (SGBs) – Government-backed and offer 2.5% interest annually in addition to gold’s price appreciation. Ideal for long-term gold investment in India.

-

Digital Gold – Popular among younger investors. With just ₹100, you can start buying gold online, stored safely by the platform.

So, the best way to invest in gold in India depends on your goals. If it’s cultural, jewellery works. If it’s financial, SGBs or ETFs are smarter.

Long-Term Gold Investment in India: Building Generational Wealth

Gold is not just for today — it’s for tomorrow, and even the generations after. Many Indian families see gold as a way to safeguard future needs:

-

Education – Families often pledge gold to fund children’s higher education.

-

Marriage – Gold plays a central role in wedding expenses.

-

Retirement – For many retirees, selling gold provides a financial cushion.

When families think long-term, gold investment in India remains unbeatable. It’s liquid, it’s valuable, and it carries emotional significance.

Gold vs. Other Safe Investment Options in India

Let’s compare gold with a few other popular investments:

-

Fixed Deposits (FDs): Safe but low returns.

-

Stocks/Mutual Funds: High potential returns, but risky and volatile.

-

Real Estate: Requires big investments, less liquid.

-

Gold: Safe, liquid, and culturally relevant.

This is why, even with modern financial products, gold stands out as one of the most safe investment options in India.

Gold Jewellery as an Investment – Is It Worth It?

Many people ask: “Is buying jewellery really an investment?” The answer is yes, but with some conditions.

-

Pros: Dual purpose (aesthetics + asset), resale value, emotional attachment.

-

Cons: Making charges reduce resale profit.

Still, for Indian families, jewellery is often bought first as tradition and second as investment. That’s what makes gold jewellery as an investment unique.

FAQs on Gold Investment in India

Q: Why gold is a good investment even today?

Because it protects wealth against inflation, provides stability, and is universally valued.

Q: What’s the best way to invest in gold in India?

If you want security and returns, choose Sovereign Gold Bonds or ETFs. For cultural needs, jewellery is best.

Q: How much gold should I buy?

Experts suggest keeping 10–15% of your portfolio in gold.

Q: Are gold prices going to rise in 2025?

Yes. Most predictions indicate that rising gold prices India 2025 will benefit long-term investors.

Conclusion

At the end of the day, gold investment in India is about more than money. It’s about family, tradition, and security. While the financial markets may change, gold’s shine never fades.

Whether it’s jewellery for a wedding, SGBs for long-term returns, or digital gold for convenience, Indians continue to trust gold with their wealth. And rightly so — because when everything else feels uncertain, gold stands tall, just like it has for centuries.

So the next time you’re wondering where to put your money, remember: trends come and go, but gold is forever.

Connect with Us

Stay updated on ethical jewellery buying, election laws, and the latest gold jewellery trends:

- Gmail: info@dreamticket.co.in

- Facebook: dreamticketofficial

- Instagram: dreamticketofficial

- Youtube:@DreamTicketofficial

- LinkedIn: Dream Ticket Jewellery

Read Our Article & News:- thedainikbharat , entrackr, sugermint, businessworld, indiatodaypost, gadget-innovations

Leave A Comment